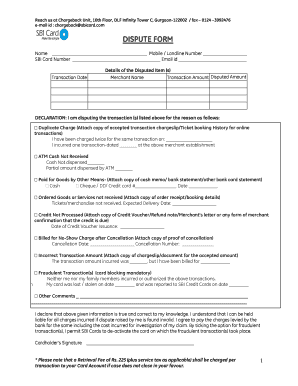

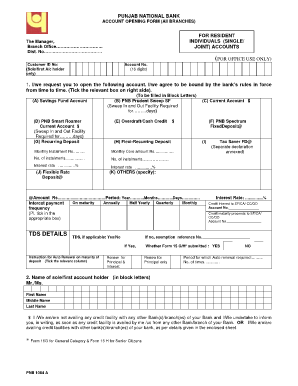

India PNB Transaction Dispute Form 2008-2026 free printable template

Fill out, sign, and share forms from a single PDF platform

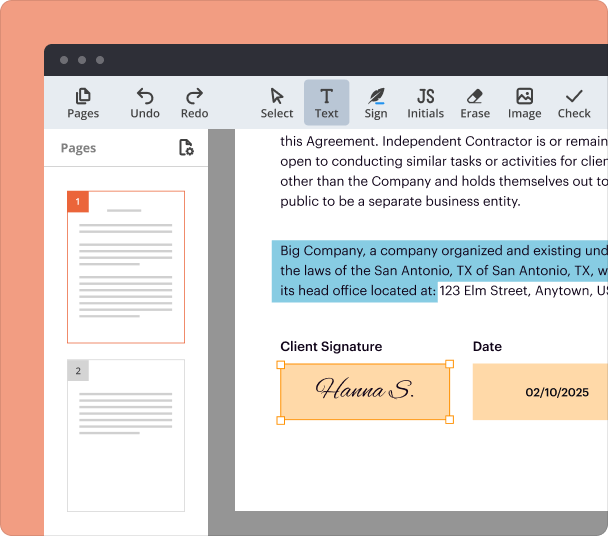

Edit and sign in one place

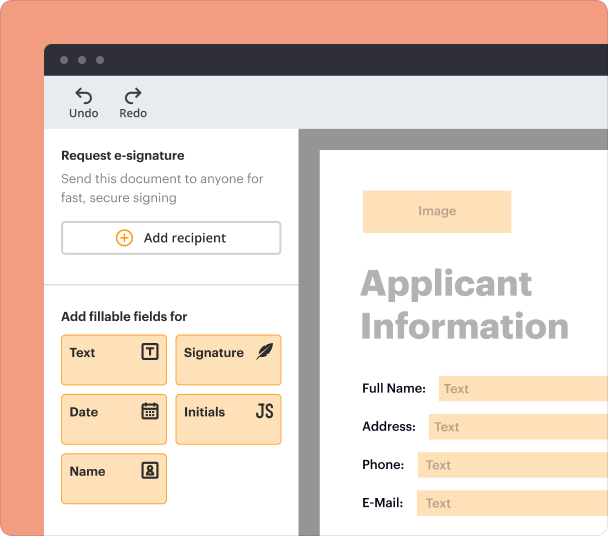

Create professional forms

Simplify data collection

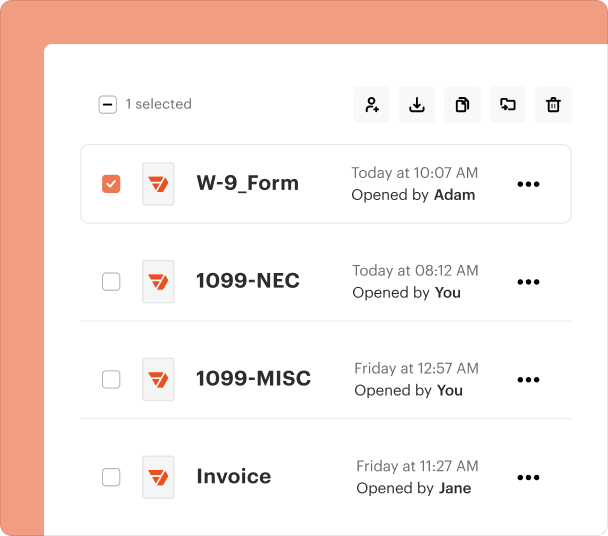

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

How to fill out the India PNB transaction dispute form

Understanding the transaction dispute process

Navigating the world of transaction disputes can be complex. Understanding the dispute process is essential for effective resolution.

-

Transaction disputes arise when there are discrepancies in accounts that require formal resolution.

-

Unauthorized charges, incorrect amounts, and unreceived services or products are frequent reasons for disputes.

-

Timely resolution helps maintain credibility with banks and protects personal finances.

Preparing to file a transaction dispute

Preparation is key when it comes to submitting a transaction dispute form.

-

Compile all records of transactions, receipts, and any relevant communication before filing your dispute.

-

You'll need to provide details such as transaction dates, amounts, and merchant information.

-

pdfFiller can help in creating, filling, and managing your dispute form efficiently.

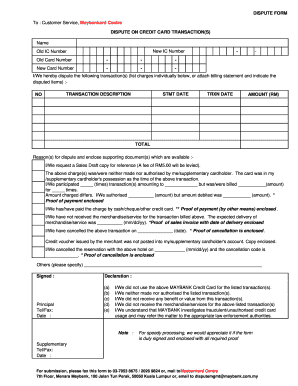

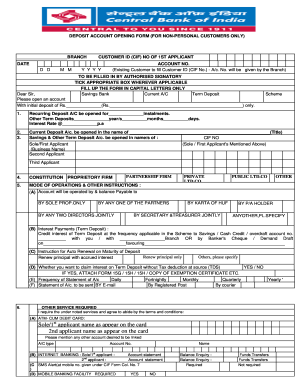

Completing the transaction dispute form

Completing the form correctly is crucial, as inaccuracies can delay your dispute resolution.

-

Follow clear instructions when filling out the form, starting from basic details to specific transaction information.

-

Be sure to accurately enter credit card information and describe each disputed transaction in detail.

-

Clearly state whether the issue relates to unauthorized transactions or multiple processing charges.

Types of disputes you can file

It's important to identify the type of dispute you're filing, as each has specific requirements and guidelines.

-

This occurs when a charge is made without your consent; recognition of what qualifies is essential.

-

In the case of suspected fraud, immediate action should be taken to prevent further unauthorized access.

-

Identify and document any charges that appear more than once for the same service or product.

-

Report any discrepancies between the charged amount and the agreed price.

-

Ensure to provide evidence of cancellation as proof for the dispute.

-

Stay aware of the expectations for resolving disputes regarding product quality.

-

If a promised credit is not received, follow established procedures to report it.

-

Document any alternative payment methods used to substantiate your claim.

Submitting your transaction dispute form

After completing your dispute form, submission is the next critical step.

-

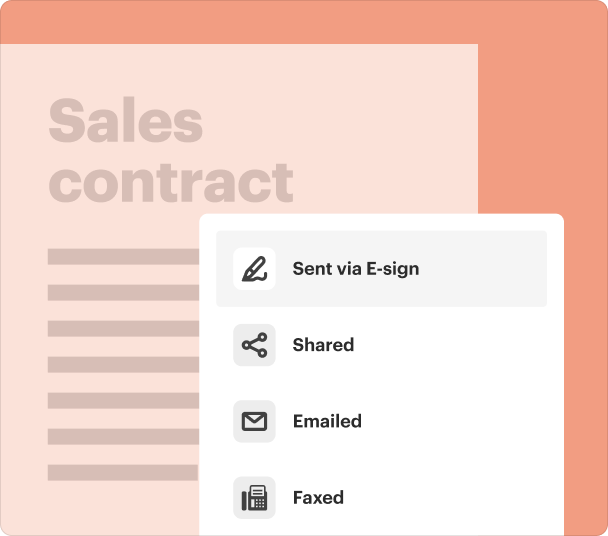

Utilize pdfFiller for a seamless electronic submission process. Ensure your form is properly formatted and saved.

-

Confirm that you receive a tracking confirmation for your submission to stay updated.

-

Keep a list of customer service contacts should you need further assistance throughout the process.

-

Be aware of expected response times for dispute resolutions to set appropriate follow-up parameters.

Utilizing pdfFiller for your document needs

pdfFiller offers a user-friendly platform for managing your dispute forms effectively.

-

From editing to eSigning, pdfFiller provides extensive tools to ease your document management tasks.

-

Quickly make changes, sign documents, and store forms in a secure, centralized place.

-

Leverage pdfFiller's advanced features to enhance your workflow and save time on document handling.

Security considerations for filing disputes

Filing disputes requires sensitive information; safeguarding your data is critical.

-

Be vigilant in protecting personal and financial information throughout the filing process.

-

Use secure internet connections and verify the security measures of the document management platform.

-

pdfFiller employs stringent data protection protocols to ensure your information remains private and secure.

Frequently Asked Questions about dispute form

What happens after I submit my dispute?

Once you submit your transaction dispute form, the bank will review the information provided. You will be informed about the next steps and any potential outcomes.

How long do transaction disputes take to resolve?

The resolution time for transaction disputes can vary but generally takes anywhere from a few days to a couple of weeks, depending on the complexity of the case.

Can I dispute multiple transactions at once?

Yes, you can dispute several transactions concurrently on a single form, as long as you provide clear details for each dispute.

What is the role of the bank in resolving disputes?

The bank is responsible for investigating your claims, verifying the details, and providing a fair resolution based on their findings.

How can pdfFiller help with filling out the dispute form?

pdfFiller simplifies the process by allowing you to fill out, edit, and manage your transaction dispute form from a convenient online platform.

pdfFiller scores top ratings on review platforms